Here’s a new way to measure Idaho’s fiscal health: tax volatility. Idaho is in the top third of most-volatile state tax revenues. That’s according a report released Thursday from the Pew Charitable Trusts, which Pew calls a first-of-its-kind national comparison.

If you haven’t yet clicked away, but you’re about to because reading the phrase ‘tax volatility’ made you think a trip to the dentist or DMV might be pleasant about now, here’s why it’s important.

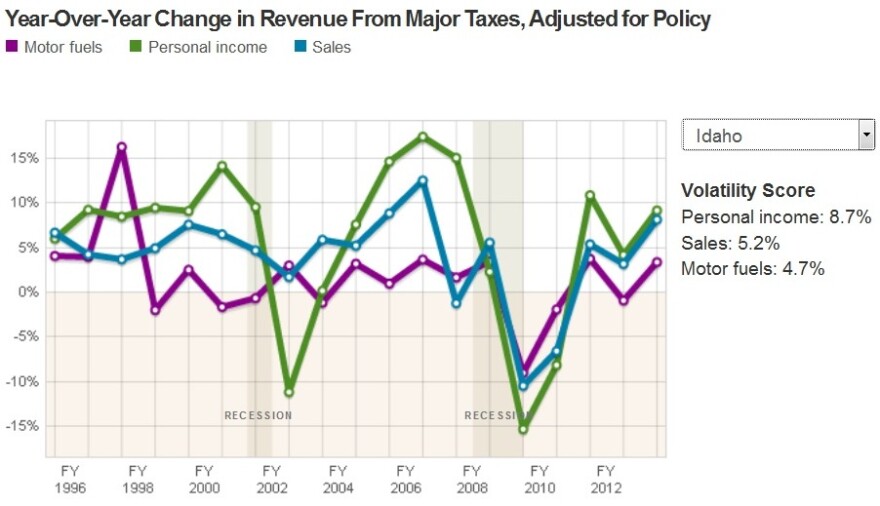

Tax volatility refers to how much a state’s revenue swings up and down compared to swings in the economy. Unstable revenues can make budgeting difficult and lead to big cuts in state programs like the ones Idaho went through a few years ago.

Volatility comes from a state’s economic health and the sources it relies on for revenue. All three major sources of Idaho tax revenue Pew lists – motor fuels, personal income and sales taxes -- took big plunges during the Great Recession.

Next door in Washington, Idaho’s least volatile neighbor, only sales tax collections took a comparable dive. Washington’s other major income streams, property and motor fuels taxes, stayed pretty stable.

Pew’s Brenna Erford, who studies state fiscal health, says Idaho’s most volatile income source is the income tax.

“The personal income tax is very responsive to economic recession,” Erford says. “So you’ll see some pretty marked declines in tax collections during bad years.”

The least stable state income sources according to Pew, are corporate income taxes and taxes on the removal of natural resources like oil and gas, known as severance taxes (think of states like Alaska, Wyoming and North Dakota.) State’s that rely on those show the biggest swings in income.

The most volatile state, Alaska, relies almost entirely on those two sources. It was more than twice as volatile as Wyoming, the state with the second biggest swings. Wyoming also gets a lot of its revenue from severance taxes but its other big sources are property and sales taxes, not corporate income taxes.

High tax volatility doesn’t necessarily lead to state budget cuts. According to Erford, states can counteract the impacts of revenue drops by maintaining healthy rainy day funds.

Volatile Wyoming keeps one of the biggest reserves in the country. During the recession Wyoming spent its savings down, but has since built it back nearly to pre-recession levels.

Idaho also spent a lot of its savings and has put some back in the last few years. At its highest pre-recession point, Idaho had enough money saved to run its government for more than two months. At its lowest, it had less than a weeks' worth. In 2014 Idaho was back up to nearly a months' worth of savings.

Wyoming had saved enough to pay for operating the government for more than six months Oregon however, where revenue volatility is higher than Idaho's, had only 11 days of savings in 2014.

The timing of Pew’s report is a bit ironic in Idaho. This week, Idaho lawmakers are meeting to figure out what the state’s tax revenues are likely to be in the coming year. They’ll base budgeting decisions on the number they come up with, including how much to put into reserve accounts. But they probably won’t be talking about tax volatility.

“One of the things that has not been done is an analysis of Idaho’s tax volatility relative to the size of its rainy day fund,” Erford says. “That’s the kind of analysis that’s really vital to policy makers who are looking to answer the difficult question, ‘just how strong are our reserves, how big should our fund be.'"

Find Adam Cotterell on Twitter @cotterelladam

Copyright 2015 Boise State Public Radio